Friday, December 28, 2007

news, news, news

new malaria vaccine shows promise. malaria is an 19th century disease, like smallpox or the whooping cough. if it had been common in the white portions of the world, it would've been brought under control a century ago. because it happens to impact the lives of poor people, it still kills about 1 million people every year and 70 million are infected with it today.

the mainstream media finally realizes that it isn't so much a "subprime housing loan crisis in america" as it is a "worldwide credit meltdown that could take at least one household-name bank down with it" (my titles, not theirs). the economist recognized this in 2003. the blogosphere has been discussing it since then. every solution discussed publicly so far doesn't seem to understand the gravity of the situation. financial engineers came up with weird new ways to circumnavigate regulations and push risk off of their account sheets. this led to underpriced risk, huge amounts of leverage, and an ever faster dollar. which is all great and fine and all until the underpriced risk turns into unrepaid debts and widespread bankruptcy of both individuals and institutions. if i had any money, i would consider putting some of it into gold and commodities right now (alcohol and cigarettes also do well during down times, but i'm not sure if that is where i want my money). if nothing else, as this story spreads the negative psychology will push gold and commodities up.

i have another new favorite blog: housing panic. it has a fun style and is written at a very approachable level. the best quality analysis is still calculated risk. it is quite US-centric, but at least mentions international factors every once in a while.

Thursday, December 27, 2007

time to cut domesticated mammals from my diet

for practical reasons for now, chicken and fish will still be fair game, but no pork or beef. if the opportunity to consume wild game or whale arises, i'll have to consider it on a case by case basis.

i'll skip the links about water consumption, GHG emissions, clogged arteries, global carrying capacity according to different diets, etc since it is all stuff anybody can find pretty easily and i don't feel like looking for it right now.

Wednesday, December 26, 2007

a reasonable approach to public smoking

i don't smoke and i don't particularly like to be near smokers in an enclosed space, but i think the complete ban of smoking in all public spaces is ridiculous. the entirety of the 643 acre campus of the University of Washington (my alma-mater) is smoke-free. indoor and outdoor. all of it. all of the time. but feel free to get as drunk as you want and puke all over the place. technically, you'll need to get a permit to serve alcohol for that.

i don't think smoking or second-hand smoking is half as big of a deal as it is made out to be. how does it compare to alcohol, depression, methamphetamines, obesity, gun ownership, homelessness, and racism in terms of lives destroyed? and yet you can feel free to walk around Seattle drunk, low, high, fat, armed, vagrant, or racist and people will let you be, would never think of saying a word. but try to light up a mild stimulant with a not entirely unpleasant odor and people assume that you've forgotten that you're in a public space and take the responsibility of reminding you as a personal mission. honestly, the only impact that sitting in an unventilated restaurant for two hours across the table from a chain smoker would have on most of us would be smelly hair and slightly red eyes. get a grip. second-hand drunkenness can leave you covered in puke, disgusted with humanity, in a fight, or dead.

so, yes, fine, if you want to be somewhere without smoke, go to one of the smoke-free restaurants. but, if smokers want to go out and have a bucket of coffee and a pack of cigarettes, i don't see what the big deal is. we don't mind when people go out do all sorts of other self-destructive things on their own time. what is it about smoking that invites so much disdain and strict public regulation?

i hope Israel's 20% rule works out. maybe some of the nanny states will be convinced to follow.

Monday, December 24, 2007

get rid of the silly bus passes

think about it. what function do they serve?

do they pay for the system to operate? not really. most of the bus system's cost is subsidized by the city.

do they keep vagrant off the bus? not really. you don't pay until you get off the bus, so vagrants have no problem getting on the bus. they only occasionally get hassled by the driver when they get off and it is a rare driver that is willing to hold up an entire bus and call the cops over $1.25.

as far as i can tell, they are a way of transferring money from companies to the city. the Seattle mayor recently enacted an initiative that more or less requires that all companies operating within the city buy bus passes for their employees. if all employees have bus passes, vagrants ride whenever they want to, and students all have passes. what is left? occasional users.

these people always pay with cash, never seem to have the right amount and generally slow the system down.

seeing as how they are occasional users, they don't account for a very large fraction of the bus traffic, so losing their fares wouldn't impact the system income very much.

so, what they should do is eliminate all bus passes and fares on the metro buses. this would eliminate the occasional rider dedicated to paying in dimes and allow riders to enter and exit through the front or back doors, reducing stop times, making the system more efficient. plus the hundreds of thousands of bus passes wouldn't have to be printed, and the pass reading and cash collecting devices could be scrapped.

i'm not saying the gains would be massive, but the cost would be virtually non-existent and the mayor could claim a victory for the environment since "free" bus service subsidized by employers within the city could at least be claimed to be better for the environment as a way to reduce car travel.

just got my EIT

without a PE, you are stuck in the bottom rungs of the industry.

the first step to getting registered as a PE was to get registered as an engineer in training (EIT). doing this requires completing an 8 hour test covering all aspects of undergraduate engineering.

i just got notice in the mail today that i succeeded on my first attempt.

so, with any luck, i'll be able to take the PE exam in the spring or next fall and be registered as a PE by this time next year.

another big wave of foreclosures coming in the new year

so, what are people buying on their credit cards if not ugly ties and unwanted sweaters?

a lot of people are relying on the easiest source of credit just to make ends meet while fuel, food, and energy prices rise. under normal conditions, this would lead to an increase in bankruptcies and foreclosures as marginal buyers were forced out of their houses. in the current bubbly conditions, with decreasing house prices and adjusting rates wreaking havoc and record high numbers of marginal owners in the market, i'd bet that people see the writing on the wall but don't want to ruin their kid's christmas, so they are pretending things are normal and pushing their problems off until the new year. lenders are probably also pushing foreclosures off until the new year to avoid being seen as the grinch.

if both lenders and homeowners are pushing things off until the new year, it seems inevitable that we will see an increase in foreclosure and bankruptcy activity early in the new year.

airport security unjustified, housing bubble global, illegal immigrants actually going home

the housing bubble is global. this may seem impossible, since all real estate is local and rather difficult to move, but debt is instantly transferable and is the fuel that powers housing prices. as debt becomes more expensive everywhere, every housing market worldwide will decrease in value because more expensive debt means lower buying power. an example from the UK "Britain's biggest mortgage lender said first-time buyers could not afford to purchase the average home in 96% of towns in the UK." 96% of towns are unaffordable. for that to mean something, you'd have to compare it to the same measure from a few years ago. by itself, though, it sounds pretty bad. i'm looking for better quality information about the international housing bubble, but haven't found anything yet. Spain and the south of France are on notice, though.

Arizona is tired of cheap labor artificially keeping the cost of food, construction, and services low. so, they have a new law going into effect on Jan 1 that will revoke the business licenses of companies that employ illegal workers. aside from driving up the prices of virtually everything in the state, causing numerous restaurants and farms to fail, and greatly depressing the housing and rental markets, the state hopes to free up medical and educational services for the legal portion of the population. it sounds like it will be an effective law, but i doubt that they have seriously thought through all of the consequences. this is a law that will quickly be repealed or go unenforced when Arizona realizes they have 100,000 too few cooks, nannies, yard workers, mechanics, and farm laborers and no white people want to take over the jobs for $3/hr.

Friday, December 21, 2007

who says they're not indigenous

The more interesting part is how much emotion gets involved in the debate on both sides. Essentially, the conflict i've heard is over their legal right to kill whales, which really comes down to a question of who and what is considered indigenous and traditional.

By the 1970s, the wordwide stock of whales was dangerously depleted, so International Whaling Commission (IWC) was created to control the whaling industry. The IWC's first act was to set a moratorium on all commercial whaling worldwide. Whale kills for continuous indigenous and scientific purposes was allowed.

Japanese whaling has continued on a smallish scale under the guise of science. To many this seems like a dishonest and somewhat evil way to pursue commercial interests. i think that it is a way for Japan to pursue indigenous rights denied to them by an odd definition of indigenous.

for some odd reason, the definition of indigenous implicitly includes "primitive" and "unrelated to money." so, ten guys in a canoe can use a high-powered rifle to kill several whales each year and give the take to their family and friend, but if they get a bigger boat or charge their friends and family for the whale products, all of a sudden it is illegal.

what is a community process of distribution of meat if not a simple commercial mechanism for distribution of goods and services? how is a big boat different from a canoe other than it being much safer for the whalers?

Japanese people have a long continuous cultural practice of whaling. They are indigenous to their land. They have as much right as any other indigenous population to a sustainable take of the whale population under the IWC moratorium. Their traditional indigenous process evolved and adapted superior technology as available, as traditional indigenous processes have always done.

So, as far as i can tell, Japan is denied its indigenous whaling rights because it is a modern nation.

This denial is so obviously unfair that Japan feels justified using the science excuse for their whaling.

i can't say that i blame them.

Thursday, December 20, 2007

time for contrarians to move to NZ

contrarians are attracted where others are repelled. they are the devil's advocate, the investor who buys the company that everyone else thinks is worthless, the person who moves towards areas that others are leaving.

as an investment practice, the idea is that the underlying business is sound and its value is only temporarily depressed by fear caused by present psychology.

at least theoretically, i am contrarian, so an earthquake in NZ makes me want to move there. i'm just not sure if this particular disaster was a big enough justification.

the idea is that such an event will scare others away from the area leaving greater opportunities open to the contrarians. and i just don't think this news will scare very many people away.

besides, i still don't have my PE. so it is still too early for me to leave the country

Wednesday, December 19, 2007

real invisibility cloak

it intercepts light on one side, converts it into plasmons, funnels them around the cloaked object, then converts them back to visible light on the other side. so, when you look at the object all you see is whatever is behind the object.

weird.

there are apparently already practical applications of the tech in the area of microscopes that all but a very small portion of the world's population will find incredibly boring.

Tuesday, December 18, 2007

birth of the renewable age

they claim to be able to produce solar panels for $1/peak watt. given an availability of 25% (peak production for 6 hrs/day) and a lifespan of 20 years, that is more than 40kWhr for $1. say the balance of system and installation costs bring that down to $40kWhr for $2. in most places in the world electricity delivered to the home is $.1/kWhr. So, for $2 you can only buy 20kWhr.

effectively, they are claiming that they can produce power on site at your home for half of the normal delivered price that the utility charges.

every previous solar power system has been heavily dependent on subsidies and belief systems to be considered at all.

so, welcome to the renewable energy age, where renewable energy is the least cost option.

(least cost is important to power companies because all of them in the US are required to provide power using the least cost option. if they don't, they get fined. if distributed solar can be proven to cost less than coal, the utilities will be required to transition to it.)

of course, nanosolar could be lying. i don't know enough about the tech to say.

this definitely won't lead to the death of power utilities, though. even if the entirety of electric demand were somehow produced on site, customers will still need to take care of times when demand exceeds supply, such as overnight. with their infrastructure already in place, electric utilities can supply this service for much less than the annualized cost of a storage system in each house. it is bad news for generation companies, but delivery companies will be fine.

apropriate technology bamboo bridge

this is the situation in the US (except for the occasional collapse that brings the assumption of expertise into question)

southeast Asian countries now have a a more appropriate option using local sustainable materials, minimal labor, and presumably at a low cost - bamboo bridges. A prof at both U SoCal and Hunan U has designed a 30' bridge rated for 8 ton vehicles using a bamboo structure built by 8 local laborers in less than 1 week. No word on expected lifespan or maintenance requirements, but bamboo should do at least as well as a wood frame bridge, since bamboo naturally resists rotting.

Bamboo is an especially good material because it is a thoroughly renewable resource, rapidly replenishing itself every year. Unlike the trees used to supply the wood for our stick-built houses which take at least decades to regrow, bamboo is a grass and can grow up to 3 feet per day.

This reminds me of a wind turbine that I want to build with a stressed bamboo frame and colorful blades made from a light fabric. It would be made of all sustainable materials, and compliment the architecture it was attached to. I have no doubt that it would be a commercial success even if it never produced a single watt. It would be desired as a dynamic sculpture signaling your dedication to beauty and the environment. The only problem is that most of the customers would be in SoCal and I have no interest in going there.

I'll probably build one at some point. A model, anyway. Here is a paper from an Indian guy on the subject.

Monday, December 17, 2007

another kind of wind energy

now available at your local freight shipyard retailer

i imagine the uptake rate on this will be quite high, since the return on investment should be pretty quick.

it makes me wonder why somebody didn't think of it 50 years ago and what similar ideas exist that nobody is pursuing today.

steam powered trains?

biomass powered transportation?

Thursday, December 13, 2007

good, bad, and fun news

The Koreas appear to be making real steps towards peace, with border crossing discussions. My personal theory is that Kim Jung Il is getting old enough that he is thinking about his legacy and has decided he would rather be remember as a belated peacemaker rather than lifetime dictator. Either that, or he sees the new wealth of Asia and wants his people to benefit from it.

Bad news:

We are all going to become more familiar with the term "Commercial Backed Securities" in the near future. These are the same thing as Mortgage Backed Securities of recent infamy but on commercial properties rather than residential. Many condo projects were funded through these mechanisms. They are the other shoe.

Also, the same reserve banks that keep saying that things are really fine, nothing to worry about, get along and do your shopping or your family won't love you anymore. Those banks have banded together to create an emergency fund to reduce liquidity problems. In Russia, this sort of news inspires people to buy furniture and jewelry because it presages inflation.

Fun news:

I'm going to make an LED grow lamp so we can have a small indoor herb garden. Plants mostly only use two frequencies of light: 400-500 nm and 600-700 nm. LEDs produce these frequencies very efficiently. I think it'll be a fun little project. You can buy them online starting at $200. I plan on spending about $40 for 150 "super bright" red and blue LEDs hoping to get the same or brighter results, in what i hope will be a more attractive configuration.

Wednesday, December 12, 2007

maybe i should rename this blog again

declining economy, national debt, climate change, why the cars of the future won't be as cool as they could be, why to never use clearwire

i'd prefer to focus on more stories of potential growth, like the new techs from the national labs, but there just aren't that many. not that i can find, anyway.

by far, most of the economic news is about market share being moved from one company to another, which is fundamentally uninteresting.

most of the science news that i can find is re-affirming assumptions that people were already pretty sure of.

and the world news is mostly meant to scandalize, rather than inform, the reader.

so, how can i talk about growing the pie on a daily basis if i can't find hardly even a passing

mention of new ideas?

we're still all in big trouble

"The amount of ice lost by Greenland over the last year is the equivalent of two times all the ice in the Alps, or a layer of water more than one-half mile deep covering Washington, D.C."

seriously, though. i will probably see large impacts from climate change before i retire.

"Inclusion of the dynamic processes of these glaciers in models will likely demonstrate that the 2007 Intergovernmental Panel on Climate Change assessment underestimated sea-level projections for the end of the 21st century."

the theory that seems most likely to me (for no particular reason, really) is that enough water will build up under the Greenland ice sheet that it will slide into the ocean. this addition of cold water will disrupt the currents that keep Europe warm. Europe will cool off enough that they will have a nasty winter followed by a mild summer where little snow melts. and we'll be on the fast track for an ice age. this is called the collapse of thermohaline circulation theory

trees are a good buffer to help prevent both warming and cooling, plus they are beautiful. i think we should plant more.

really so many more. everywhere they will grow. and come up with ways to plant more in places they normally don't grow.

new favorite blog

very detailed and approachable market analysis with an emphasis on the current credit/housing crash. if you don't think it is a crash yet, give it a few months. i think we'll see around 25% of Americans losing close to half of their paper wealth from what they considered their safest investment.

how this can possibly not cause a consumer-led recession is beyond me.

actually, i just thought of a way. most of the paper wealth being lost will be lost by people who own homes. these people are mostly older folks who tend to not throw their money around in the first place. people who do throw their money around (and thus most strongly support our consumer-based economy) rent their place to live. the excess housing created by the building boom will lead to lower rent prices as more housing units compete over the same renter pool. the money not being spent on rent by the young and feckless will instead be spent on ipods and video games. and everything will be ok.

long term homeowners hoping to retire on their craftsman-style bank accounts will have to lower their expectations, but only the ones who unwisely raised their expectations in the first place will be disappointed.

a house is a place to live, not a way to get rich.

well, in many markets today, a house is a way to get poor.

Tuesday, December 11, 2007

clearwire sucks

Clearwire sucks. I was patient with them. I gave them far more chances than they deserved and now I'm probably going to get stuck with a $200 cancellation charge.

I got clearwire about 7 months ago and was initially happy with the service. I even recommended it to my sister. Then, without notification, they killed my connection. No warning, nothing. Just dropped. They said I'm using too much continuous bandwidth. So I asked for an indication of how much was acceptable. They asked me to reduce my use because it was hurting other users. So, wanting to be a good citizen, I capped my continuous up and down rates. A few weeks later, they drop my service again. Again with no notification. I call in and ask again if they have a usable definition of "acceptable use." Maybe this tech was new or didn't know the Clearwire policy of avoiding useful answers and he told me that down rates aren't a problem, but keep the up rate below 8 kB/sec and we should be fine. So, I did that and I was ready to live with it. Then they throttled P2P programs. They never said that they did, but it was obvious when they did it. One day I was getting a nearly continuous 150kB/sec down. The next day, I was lucky to see an intermittent high of 15kB/sec down. Again, they never notified users of a change of service. I would have stayed with them even through this P2P throttling, but now they've cut me down to limp mode (around 58kb/sec) to get me to call them again. The only problem is that my VoIP phone won't work at this transfer rate, they don't reply to incoming emails, and the people you can reach through their chat application are useless.

All up, they clearly don't want customers that intend to actually use their internet connections.

for lots of similar stories see the dedicated blog: Clearwire Sucks.

mesh networks and socialism

the current information distribution model is more like a billboard, where i can post on the billboard and you can read from it, but i can't talk directly to you.

to me, this means that the current model is more capitalist, insofar as somebody must own the billboard, and mesh networks are- for the lack of a better term- socialist.

of course, there are other advantages to the mesh network concept, aside from them being immune to central control. they are robust, efficient, and could seemingly provide ridiculously high transfer rates.

the idea is pretty simple. instead of having dedicated service devices and dedicated customer devices like the current model, every device is both a customer and a service provider. so, my device can talk directly to your device instead of going through a mediator. or, if my friend's device wants to talk to your device, my device can serve as the intermediary.

now, if every device in an office had this ability to talk device to device and retransmit messages between devices- every cellphone, computer, mp3 player, printer talking to every other device- you wouldn't need an office network anymore, would you?

well, what if every device in the world had this ability? now you only need a network for long range communication between populated areas.

that is the theoretical ability of mesh networks, to provide a virtually uninterruptable communication system to replace traditional information transmitters like phone companies, cable tv networks, internet service providers, cell phone companies.

it is a kind of old idea at this point and seems to be having trouble getting a foothold at the consumer device scale at least partially because the companies that have the ability to produce the tech are the ones that have the most to lose from its adoption.

google have a lot to gain from more people being lost in the internets. they have expressed interest in some of the resources necessary to push the tech forward, they are pretty subversive guys, and they recently supported the Meraki mesh network in San Fran, providing ad-based internets to many SF neighborhoods.

Monday, December 10, 2007

dumb new science

the concept is that it focuses light onto a box of CO2 and water and eventually produces something useful, theoretically a liquid fuel. the mechanics, chemistry, and physics behind it is probably very interesting. but, in the end, what are we left with? an ugly, expensive, and inefficient tree replacement.

except that trees also produce fresh water (by causing rain), reduce climate variability (by increasing humidity, shade, and reflecting a lot of sunlight energy), improve the beauty of an area, efficiently recycle themselves, can act as long term or permanent CO2 traps, can provide a wide range of other useful products, can support wildlife, filter the air, reduce erosion, and can be virtually free to produce.

so, what i want to know is who is doing research on reforestation? what it would take to reclaim the Sahara? how much new forest would it take to absorb the total amount of CO2 that we put in the atmosphere each year? as a form of carbon sequester, how much is an acre of rain forest worth?

these sorts of efforts are the definition of growing the pie because they actually increase our resource base.

Friday, December 7, 2007

how to shrink the pie

seriously, it is the one thing that will shape politics, the economy, international relations, etc more than anything else for the next several years at least.

the US housing crash has accelerated to a point where politicians have decided to try to screw things up. before considering the details of any plan, it is obvious that the plan must fail at stopping the crash. it could slow the crash or shift the cost of the crash more in one direction or another, but it cannot possibly stop the crash.

the US is far from the only country that will experience this housing crash. most of the western world followed us on the way up and most of them will follow us down, some of them more much more dramatically than us (if you were thinking of buying a villa in Spain or the South of France, you may give it a few years).

this is why the gov't cannot stop the crash according to someone who sold billions of dollars worth of these loan, from my favorite financial website:

"How can any of this get repaired unless home values stabilize? And how will that happen? In Northern California, a household income of $90,000 per year could legitimately pay the minimum monthly payment on an Option ARM on a million home for the past several years. Most Option ARMs allowed zero to 5% down. Therefore, given the average income of the Bay Area, most families could buy that million dollar home. A home seller had a vast pool of available buyers.

Now, with all the exotic programs gone, a household income of $175,000 is needed to buy that same home, which is about 10% of the Bay Area households. And, inventories are up 500%. So, in a nutshell we have 90% fewer qualified buyers for five-times the number of homes. To get housing moving again in Northern California, either all the exotic programs must come back, everyone must get a 100% raise or home prices have to fall 50%. None, except the last sound remotely possible."

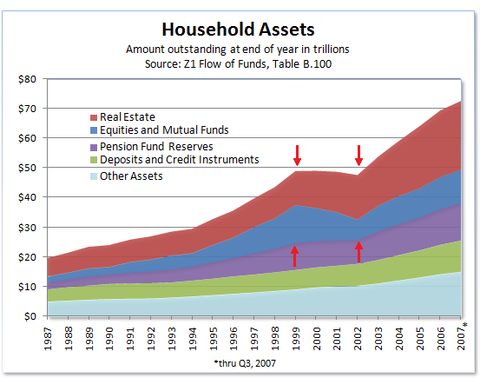

So, recognizing that the gov't will not be able to double everyone's income or bring the ridiculous speculative exotic loan packages (not to mention people convinced that they want and will benefit from these terrible, terrible financial decisions) back to the market, there really is only one option. Prices must fall to a point where people want to buy and can afford to do so.now, if you think i'm overreacting to the importance of this price decrease, let me remind you that most of the growth of wealth over the last 6 years has been directly from housing appreciation, as can be seen in the chart below.

much of the rest of the growth of wealth was indirectly fed by housing appreciation. people seeing their house wealth increasing, decided to take out a second mortgage and buy a car, a vacation, new furniture, whatever. the point being that the rest of the economy was pulled up by housing appreciation.

in the same way, the economy will be pulled down as the housing market crashes. mercedes and bmw should be worried. airlines should be worried. china, as our largest supplier of stuff, should really be worried.

the average american could be poorer each year for at least the next few years.

what i don't understand is why the impact has been so limited so far. we've had a small slump in the stock market, but now it looks like it is recovering. i don't get it.

then again, the internet bubble took 6 months to deflate even while every adviser and their dog barked at people to get out of the tech stocks. housing is traditionally considered a safe investment and today the general sentiment is still that housing is safe. decades of training has ingrained this idea in people's heads. maybe it will take more than a year or two of depreciation to convince people that any grossly overvalued asset will depreciate no matter how stable of an investment it was two generations ago.

Thursday, December 6, 2007

how to not grow the pie

we got richer through asset appreciation. specifically, our largest asset. our homes appreciated like gangbusters. they set new all-time highs relative to incomes in every major city for several years in a row.

the important part in that statement was "relative to incomes." this means that every city in the US became more expensive to live in. it happened in every city, so no special factors can explain it.

simply put, people lost their shirts in the internet bubble and decided to put their money in something safe, the Fed made credit cheap, loans became easier to get, prices increased, lenders used the recent history of high appreciation to justify making loans easier to get, people saw a history of rising prices and wanted some of the action so they were willing to pay more, the Economist called it a dangerous bubble and declared it would soon pop.

wash, rinse, repeat. for five to seven years, depending on the city. in many markets, prices doubled or more relative to incomes.

the thing about housing is that, relative to incomes, pricing basically hadn't changed for 80 years. this makes sense because a middle-class neighborhood is pretty much always going to be a middle-class neighborhood where people make middle-class money. so, how is it now that people should be paying twice as much today as 5 years ago?

they aren't. people couldn't possibly afford to do that. they saw an investment opportunity that justified the risk associated with weird loans with low intro payments, no cash down, etc and they jumped in head first.

now that these weird loans are resetting to their regular rates and the houses haven't appreciated their way to glorious wealth, people are screaming bloody murder and insisting the gov't do something to help, because (surprise surprise) they can't afford the payments that the evil loan officer forced on them. foreclosed houses help drag the market down, forcing more people into the unenviable situation of owing more on the house than the house is worth and knowing that the house will continue to lose value. some of these people decide to cut their losses and give the house back to the lender. this further depreciates the market. a bit of a vicious cycle.

this is a big deal, some people are losing imaginary wealth at an alarming rate. the average house in California lost 10% of its value last year. if the average house cost $500k, that is $50k in money gone from what is meant to be a very stable investment.

this kind of loss of wealth has the ability to derail the economy a fair bit. nobody knows quite how much, but quite a lot, probably. the gov't wants to help, but can't possibly. they have proposed a deal that is nearly finalized, but it can only slow the process down. to suggest otherwise is to claim that housing in every major city will permanently be more expensive relative to incomes without any change in circumstances whatsoever. maybe one or two cities have had areas with changes in demographics where formerly working-class neighborhoods are now middle-class, but everything else can only revert to the previous median.

prices will return to their normal levels relative to incomes. this is a pain, a rather big pain for many, but it is the unavoidable result of misplaced trust, greed, and lack of foresight.

it will slow our economic growth for a while, it has caused a couple of banks to fail, it may force more than a few boomers to stick it out at work for a few extra years because they were counting on their house to fund some of their retirement, it has damaged our currency, and it should cause all of us to be extra skeptical of "experts" that consistently support the industry that pays their salary.

ideally, we will learn from this bubble and the Fed reserve will take action to reduce the severity of the next one in exactly the same way that they didn't do for this one or the one before it. i'm not holding my breath. the Fed seems to like growth, sustainable or otherwise.

too cool techs from national labs

growing the pie is risky. it generally costs a lot and often returns nothing of commercial value.

that is why we have national labs, a Department of Energy, and universities where people get funding mostly from the federal gov't to do basic research on everything from cold fusion to cosmic dust. much of the research won't benefit anyone for decades. some of it will never go anywhere. but, this week i heard about two ideas that will directly impact all of our lives, though we may not be aware of it.

the first is from the GridWise Alliance at the Pacific Northwest National Lab. Most of the ideas here bore me because they are about how to make your electricity supply plan more like your cell phone plan, which is to say complicated and annoying. This would be great for private utilities because it would give them the chance to confuse both their customers and their regulators and make lots of money (taking more of the pie). Public utilities have no profit motive, so they don't adopt a technology unless it will save the customer money. I don't see that this technology has the ability to save anyone in the PNW any money in real life, but i'm off topic.

the cool thing is an inexpensive tiny little chip that senses an impending blackout and prevents it from happening. simply put, blackouts are caused by too much load relative to supply. so, utilities have schemes for how to automatically reduce their load (by turning off power to neighborhoods or entire cities) to prevent a system-wide collapse, but these schemes are expensive, inefficient, and politically difficult. what this tiny little chip does is briefly turn off load that nobody will notice, like your water heater, clothes drier, A/C, the heating element in your dishwasher. what we're talking about is a 10 minute outage every 5 years or so, something that absolutely nobody would ever notice. what society gets in return is a significantly more stable and possibly less expensive electrical supply. this is especially significant when we consider the amount of wind generation many states have decided to mandate be installed. wind power adds instability to the electric supply, these chips installed at virtually no cost in all of our heavy load devices would counteract this by adding stability, effectively reducing the cost of adding wind power to the system. there is no such thing as a free lunch, but this device seriously strains the rule. it is the biggest thing in power engineering since HVDC, maybe bigger.

the second innovation is in material science and is more likely to impact your life in a way you'll notice. the Oak Ridge National Lab has created a highly waterproof low cost material. think gore-tech on steroids. i think the first commercial application that we'll hear about will be a lifetime car polish, then the next generation of outerwear, then who knows. what would you want to be waterproof if it didn't cost anything and lasted forever? unwettable paper? ultra stain-resistant clothes and carpets? ever-dry building materials for houses? stay-dry hair treatment? i dunno how you'd wash it out, though. would you want your sunscreen to keep you dry too, so water would bead up and roll off your skin like it does on a sea lion? i'd try it. there are surely an unimaginably huge number of applications out there.

Wednesday, December 5, 2007

hey look, it's me

I'm still featured on the UW EE dept website.

I'm the pale bearded one who looks like he hasn't gotten enough sleep recently. The one on the right.

The big metal thing is our ambitious robot. After years of reflection (honestly, I still think about it pretty frequently, 4 years after the fact now), I've decided that our tactic and design were good, we just overestimated the quality of a part we had to buy from a vendor.

why the US will always win

in the very near future, China will have the largest, most powerful economy in the world. it may have it already. considering how much control the central gov't has over the nation, it probably is the single largest force in the international economy. for example, they control the yuan exchange rate and hold huge amounts of US dollars. we are one act of communist policy away from having a violently crashing dollar.

but they have an obedience problem. or, rather, a lack of disobedience problem that will force them to remain a commodity-driven economy until they shake it.

the US economy, more than any other, is driven by innovation. this is party because we have little respect for elders, tradition, the powers that be, or the opinions of our professors.

if Bill Gates or Fred Smith had listened to their parents, families, or professors, we wouldn't have Microsoft or FedEx today. most American companies founded since the 1950s probably have similar foundations.

so, China is great at copying things and that will take them through meteoric growth for the next decade or so and will probably produce several billionaires, but innovation is what we need more than anything else to go forward as a civilization or even as a species and innovation is what Americans and the American system are the best in the world at.

this rant was inspired by a CNN article this morning about how fans in China are being trained in what sorts of cheering are appropriate for the Olympics.

please note: no part of this is intended to be racist, xenophobic or similar. i'm just pointing out that different cultures are better and worse at different things. in many ways, i envy the order and efficiency with which China can operate. the US is a bit more chaotic and disobedient. that is the price we pay as a society to be able to be more innovative.

Tuesday, December 4, 2007

cool, weird cars

but not because of their CO2 impact.

not at all, in fact. when i think about how to reduce CO2 impact on transportation, i focus more on freight. we waste huge amounts of energy transporting products across the country using tractor trailers because our freight train system doesn't function well enough.

it seems to me, the entirety of the long haul trucking industry could be displaced by a properly functioning rail system. for an example, you can look at virtually any other modern country. none of them have to resort to tractor trailers like we do.

maybe we could throw in decent passenger lines while we're at it.

this would do far more for the environment, road safety, and economic stability than any of the "green" vehicle efforts so far.

but my topic for today is cool weird cars. i like them.

these two are both three-wheeled and both offered as either battery powered or hybrid powered. both in the $25-$30k range. both theoretically available in the near future.

the Aptera:

the VentureOne:

the Aptera claims a ridiculous fuel efficiency as its most important selling point, the VentureOne claims 100 mpg, but also does the neat trick of leaning like a motorcycle.

both of them are missing the point. sure, they are fuel efficient, but who really cares about that.

the Prius is successful because it is an opportunity for people to look like they are doing what's best for the environment without paying lots of extra money or sacrificing much in terms of comfort, safety, or performance. they want to be seen to be doing their part, not sacrificing their identity to the gods of the environment. the Honda Insight failed because it sacrificed too much. the Toyota Camry Hybrid failed because only the driver knew they were driving a hybrid, not the neighbors.

the Aptera will flat out fail because it is going down the same path as the Honda Insight, offering people the chance to look ridiculous while riding around in a grossly overpriced death trap that will fly off the road with the first side wind. and with just the one driven wheel in the back, what happens to your traction any time the weather turns bad?

as for the VentureOne, it has a chance of success, but this is despite it being a hybrid. i like electric, i think it is the way of the future, but i think it has no business on this vehicle. this vehicle is for people who want a motorcycle, but also have kids and can't accept the danger associated with riding a bike. it is a good market that the mazda miata has been dominating for more than a decade.

adding the electric drive train just confuses things. so, now they are trying to sell it to people who want a motorcycle, are concerned about safety, don't want to go particularly fast, see themselves as techno-savvy, and want to appear green. about five people in the world, then.

why are they making things harder for themselves? just slap a 1.6 liter hayabusa engine in there, tell everyone it does 187mph and 0-60 in 3.5 seconds and is like wearing a helmet for your whole body and watch the orders fly in. honestly, if anyone actually buys one of these, the first thing they will do is tear the electric motor out and replace it with a proper engine.

that being said, i'd probably still buy one despite the electric motor if i had $25k to spend on a toy. i would definitely ask how much they would drop the price to keep the drive train, though.

as for the aptera, the embarrassment of owning a car that probably couldn't maintain traction on a smooth gravel road or a wet asphalt one would be too much. if someone offered me one as a gift, i would politely accept, then find someone i don't like very much to give it to.

debt

we have a $9,000,000,000,000 national debt, mostly held overseas

that is $30,000 per citizen (man, woman, child), roughly enough to buy a new house in Ohio for every family in the country, or a 350z for every person, or five wars in Iraq. it is larger than the entire economic output of the 200 poorest countries in the world combined.

this debt, it will crush us.

because, like any debt, we pay interest on it. traditionally, it has been a safe investment in the safest currency, so our lenders were willing to give us good rates. if people start to reevaluate how safe of a currency it is, this rate will increase.

let's pretend the current rate is 4% annually (minus the current 3% inflation rate, this gives our lenders a 1% return), that means (only!) $360,000,000,000 of our annual national budget is spent servicing debt. in other words, only $1,200 worth of taxes per citizen (call it $3600 per household) goes straight down the toilet every year to pay for interest on past expenses.

if people start to expect that the US dollar will inflate at an average 4% instead of 3%, they will expect a 5% interest rate on their loans to the US just to maintain their 1% return. additionally, lets say that some of them start to wonder if the US will ever actually pay this money back. so the market demands 6% interest to loan money to the US to account for the increased risk. now, servicing the same debt costs us $540,000,000,000; $1800/person; $5400/family.

and that is just to keep the current debt level, with no effort to reduce debt balance whatsoever.

and keep in mind, the baby boomers can be counted on to make matters worse as they retire, stop paying taxes, and start taking money out of the system through social security and medicare.

much of this debt is owned by China and Saudi Arabia, btw

just another thing to keep in mind if you're worried about depreciated houses killing retirement funds, record high levels of credit card debt, low consumer confidence levels, negative saving rates, increased inflation, rising energy prices, increasing jobless claims, and decaying infrastructure.

Monday, December 3, 2007

news, some of it good

European forests are growing faster than expected and absorbing more CO2 in the process

http://www.sciencedaily.com/releases/2007/11/071129113752.htm

while i hope the scientists involved have unimpeachable dedication to impartiality, it should be kept in mind that Europe, being part of the Kyoto Protocols, has a lot to gain by overestimating the CO2 absorption of their forests. i'm not calling anyone out yet, i'm just pointing out which direction their incentives point them.

the gov't talks with the lending industry about resolving the housing mess is just for show. the banks repackaged and sold the mortgages already. this means the lenders cannot change the rates to the homeowners without paying the difference to the debt owners. none of the major lenders have the cash to do this.

so, why the highly publicized talks? to try to increase consumer confidence.

http://seekingalpha.com/article/56074-hank-paulsons-arm-bailout-swing-and-a-miss

Sunday, December 2, 2007

the economy, development, and the environment grossly oversimplified

the most important goal for humanity for today is unity, preferably world unity of a type that will make wars unthinkable. this will allow more of the world resources to be directed to efforts that will benefit humanity, such as education, education, and education.

given the McDonald's Theorem (that no two countries that both contain a McDonalds Franchise will ever go to war with each other), it seems the surest route to world peace is through the development of strong economic ties.

but globalisation has been, in short, a failure. using a simple self-centered homo economicus model for all parties involved, Adam Smith style, failure is the obvious and inevitable end of any such efforts. how can a wealthy and powerful party seeking to maximize its own short term interests possibly help a poor and powerless party? such is the nature of the predominance of the efforts so far. the only poor nations that have benefited from globalisation so far have been China and India. they only benefited because they were strong enough to take beneficial parts of the globalisation package, without taking on the destabilizing parts. neither country, for example, lets international companies set up shop inside their borders. by law, every company operating in China is majority owned and controlled by Chinese people.

so, what is the solution? three spring to mind. 1) small poor countries can band together as negotiating blocks (South American Union, African Union) so that negotiations will at least be between large rich parties and large poor parties. 2)small poor countries can choose to tell the rich countries to go get stuffed, nationalize their resources and aggressively prepare their population and economy for participation in the international market. 3)the IMF and WTO can decide that their goal is to achieve the best long term solution for humanity rather than pursue their own short-term interests. and it is absolutely in everyone's best interest for the world to economically flatten significantly. not only so we rich can live with a clear conscience, knowing that no large group in the world is in desperate condition, but for far more selfish reasons.

there are only so many resources in the world. there will only ever be so many. so, it sounds like a zero-sum game, that the only way for me to become richer is for somebody else to become poorer. fortunately, this is strictly false. since the 1960s, cars have become more safer, faster, more efficient, more comfortable and less polluting, yet require less resources to build. human ingenuity has increased the size of the pie.

one man did more for the automotive industry than probably the next 1000 others. Mr Deming came up with a novel production process. he tried to get the American companies to use it, but none were interested. eventually, he found a willing audience in Japan. his process gave Japan the tools to make the best cars in the world.

as luck had it, Deming was born in Sioux City, Iowa, where he learned to read and write, where his mind was considered valuable, where he was safe from wars and famine, where he didn't have to struggle to make ends meet. according to some estimates, less than 1% of the current world population lives in these conditions that are a prerequisite for a mind to be able to fully flourish. assuming that people with his same potential are evenly distributed across the plant, that means that at least 100 people capable of revolutionizing a field have passed through life without the proper circumstances to develop. how many Einsteins are born into that 99% of the population? Bachs? Amperes? Yves Saint Laurens? TMBGs? honestly, what could the other 5.9 billion people in the world contribute if they had the opportunity and the right motivation?

in short, many of humanity's seemingly intractable problems probably aren't. but the people that could best solve them are dying of smallpox because we are part of a system where it is expected that parties pursue their own best interests even to the detriment of others.

if this is accurate, the way forward is both pretty clear and fairly impossible. we need a shift in mentality from maximizing our own short-term benefit to either maximizing our own long-term benefit or, ideally, maximizing the benefit of humanity. either that or an international body motivated by humanity's best interests and with real power needs to be created.

i don't know what these solutions look like in real life or how they can be implemented in real terms. why would a conflict-based self-interested system create a higher level of organization to which they have to cede some of their power? the colonies united to fight the British, the EU united to fight the US, two world wars gave us the inept UN, what will it take to truly unite the world?

global warming, widespread economic instability, and peak oil seem like reasonable candidates to me, since they are all "crisis of the commons" problems.