seriously, it is the one thing that will shape politics, the economy, international relations, etc more than anything else for the next several years at least.

the US housing crash has accelerated to a point where politicians have decided to try to screw things up. before considering the details of any plan, it is obvious that the plan must fail at stopping the crash. it could slow the crash or shift the cost of the crash more in one direction or another, but it cannot possibly stop the crash.

the US is far from the only country that will experience this housing crash. most of the western world followed us on the way up and most of them will follow us down, some of them more much more dramatically than us (if you were thinking of buying a villa in Spain or the South of France, you may give it a few years).

this is why the gov't cannot stop the crash according to someone who sold billions of dollars worth of these loan, from my favorite financial website:

"How can any of this get repaired unless home values stabilize? And how will that happen? In Northern California, a household income of $90,000 per year could legitimately pay the minimum monthly payment on an Option ARM on a million home for the past several years. Most Option ARMs allowed zero to 5% down. Therefore, given the average income of the Bay Area, most families could buy that million dollar home. A home seller had a vast pool of available buyers.

Now, with all the exotic programs gone, a household income of $175,000 is needed to buy that same home, which is about 10% of the Bay Area households. And, inventories are up 500%. So, in a nutshell we have 90% fewer qualified buyers for five-times the number of homes. To get housing moving again in Northern California, either all the exotic programs must come back, everyone must get a 100% raise or home prices have to fall 50%. None, except the last sound remotely possible."

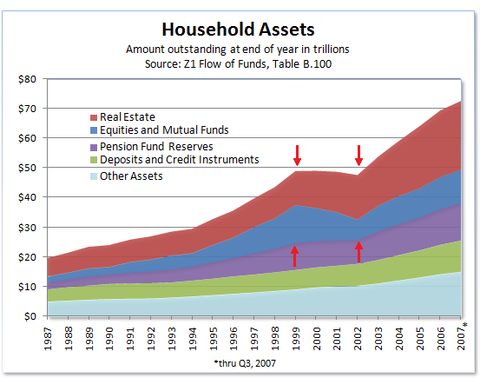

So, recognizing that the gov't will not be able to double everyone's income or bring the ridiculous speculative exotic loan packages (not to mention people convinced that they want and will benefit from these terrible, terrible financial decisions) back to the market, there really is only one option. Prices must fall to a point where people want to buy and can afford to do so.now, if you think i'm overreacting to the importance of this price decrease, let me remind you that most of the growth of wealth over the last 6 years has been directly from housing appreciation, as can be seen in the chart below.

much of the rest of the growth of wealth was indirectly fed by housing appreciation. people seeing their house wealth increasing, decided to take out a second mortgage and buy a car, a vacation, new furniture, whatever. the point being that the rest of the economy was pulled up by housing appreciation.

in the same way, the economy will be pulled down as the housing market crashes. mercedes and bmw should be worried. airlines should be worried. china, as our largest supplier of stuff, should really be worried.

the average american could be poorer each year for at least the next few years.

what i don't understand is why the impact has been so limited so far. we've had a small slump in the stock market, but now it looks like it is recovering. i don't get it.

then again, the internet bubble took 6 months to deflate even while every adviser and their dog barked at people to get out of the tech stocks. housing is traditionally considered a safe investment and today the general sentiment is still that housing is safe. decades of training has ingrained this idea in people's heads. maybe it will take more than a year or two of depreciation to convince people that any grossly overvalued asset will depreciate no matter how stable of an investment it was two generations ago.

No comments:

Post a Comment